Email Glen Greer

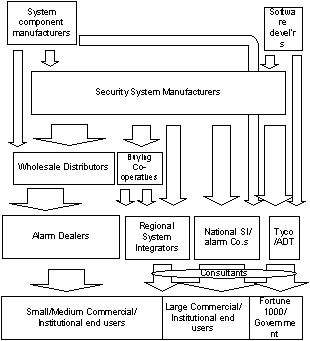

Market Channels in the US Electronic Security Industry

Selling to the Electronic Security Equipment market is done in a number of ways

- through wholesale distributors

- direct to alarm dealers

- direct to end users

- through OEM arrangements with other suppliers

When the industry was less mature, picking a channel was a much more difficult decision than it is today. Up until the early 1990's, the choice was fairly irrevocable and determined what kind of dealers would handle your equipment. Larger dealers who bought direct from manufacturers would not use equipment that was available in distribution. This was based on the usually misguided belief that it was important to have some kind of exclusivity of product.

Today, many dealers have demonstrated this to be false and in particular, the largest, national companies have not hesitated to use the same equipment that is available in distribution. The fact that they will typically buy it for around 50% of what the smaller dealer pays is seen as a sufficient advantage. Here is our brief overview of the channels available.

Wholesale Distribution

Wholesale distribution offers many advantages to the new entrant to the US security market and has been the chosen method for the vast majority of entrants, whether domestic or foreign.

It used to be the case that more complex products were not sold through distributors. However, certain distributors are developing the capability to support dealers who use relatively complex products. This is most noticeably the case in Fire products, where the regulatory problems mean that the small dealer inevitably needs help. It is now becoming the case in Access Control and CCTV. In time, it will come in Intrusion products.

There are a number of significant downsides to selling through distribution in the USA:

Distributors, whatever they say, do not make significant and continuous efforts to promote any one product. If they promote at all, it is on the basis of a quid pro quo, and they will do the same for a competitive product when it comes along.

Companies who sell through distribution have to advertise and promote their product, since all their competitors do so, and the distributor does not. This involves attending major national and regional trade showsas well as advertising in a large number of security industry magazines. This is a significant expense.

The choice of distributor is a relatively stark one. Either ADI, the dominant player, or one of the much smaller companies, or all of them. Most manufacturers do not try to get the possible benefit of giving a single distributor an exclusive. This is because an exclusive is of no value unless the product has some unique appeal.

Selling Direct to Installing Companies

Selling direct to installers is the natural choice for more complex products that require a large amount of sales effort and support. By selling direct, the company has the option, though not the necessity, to control access to the product to only authorized or qualified dealers.

This could be a key part of the product strategy. The most important aspect of this is preventing smaller dealers from bidding on specification jobs that have been created by an authorized dealer. This is done either by not selling at all to such dealers, or by selling at loaded prices to prevent their competing on price with the authorized dealer.

In addition, the company is not forced to undertake an expensive, nationwide advertising campaign, nor to go to trade shows, to be on a par with the other products in distribution and to underpin the distributors sales efforts.

The most significant downside to selling direct is the need for a high level of sales effort, which has to be addressed individually to the target dealer. With the size of the USA, this either limits the territory that can be served or increases the sales costs significantly.

Selling Direct to End Users

This is an expensive option, with a very long lead time for sales. It is undertaken usually when it is the only practical means for the company to reach its customers. It is common in Access Control in the USA, much less so in other segments of the industry. It appears that the propensity of end users to want to buy direct goes in cycles. At some times they are convinced of the benefits of working with dealers or systems integrators, at other times they get enamored with the potential savings from buying direct.

How to choose

The single most common question that new clients want me to help them with, is making the choice of channel. In fact, the only ones who don't ask this early on, have already made an assumption about which one they will choose. Often, they have reached a conclusion too quickly.

Look at the competition

I believe that the place to start is similar to the decision about entering the market in the first place. If your product is to succeed, it must displace another product for at least some customers. You have to identify the product(s) that yours will displace (right down to model number) and the reasons why the customers will switch. Ask yourself if there is a reason why they will buy your product differently. Nine times out of ten, you will choose to sell the same way the competitor does. If you think your product is the one in ten that can be sold a different way, you may be right, but you have added another challenge to the already serious problem of displacing the competing product.

No competition?

If your product is so different that you have no existing competition, then the choice of channel is a bit easier. For low unit cost products (sub $1000 per purchase), it is hard to beat wholesale distributors as a way to get started. As mentioned above, it is possible to go on to sell direct later. An added advantage of this approach is the very serious evaluation your product will get from the product specialists at the distributor. They are very reluctant to give shelf space and catalog space to something that they don't think will sell.

For higher value products, you must do a careful assessment of the decision making process that leads to the purchase decisison. The decision maker may be the dealer, systems integrator, consultant, security director, IT manager or a committee. For each, a slightly different marketing mix is necessary, including the choice of distribution channel.